THE SEIA REPORT Q3

By Sam Miller , CFA®, CAIA®, Senior Investment Strategist

What are GICS?

Global Industry Classification Standards (GICS), launched in 1999, is a taxonomy for publicly traded companies. It assigns each company a sector, industry group, industry, and sub-industry based on its principal business activity. Initially constructed with 10 high level sectors, there were no major changes until 2016, when Real Estate was carved out of Financials to create an 11th sector.

What is changing?

Now, two years later, the sector structure is changing again. Due to the evolution of the economy via technological advancements and mergers, restructuring, and consolidation, the Telecom Services sector has dwindled in size and currently only contains three companies (AT&T, Verizon, and CenturyLink). To more accurately reflect the scope of telecommunications companies in today’s economy, GICS is renaming the sector to Communication Services and welcoming familiar internet and media names like Facebook, Netflix and Google into the fold. 19 companies (5 Tech and 14 Consumer Discretionary) will be moved into this new sector after which time it will make up about 10% of the S&P 500. Correspondingly, the Tech sector will drop from roughly 25% to 20%, while Consumer Discretionary will drop from roughly 13% to 10%. This will result in more than 8% of the S&P 500 being reclassified, the biggest change to the GICS sector structure in history. The changes officially take place after the close of business on Friday, September 28, 2018, but most index funds will slowly transition in the months prior.

In the end, the classification changes result in making each of the sectors more equal by redistributing market cap and reducing concentration (see Figure 1).

What does it mean for my portfolio?

While all of these changes will take place automatically

behind the scenes, there are a few items to note:

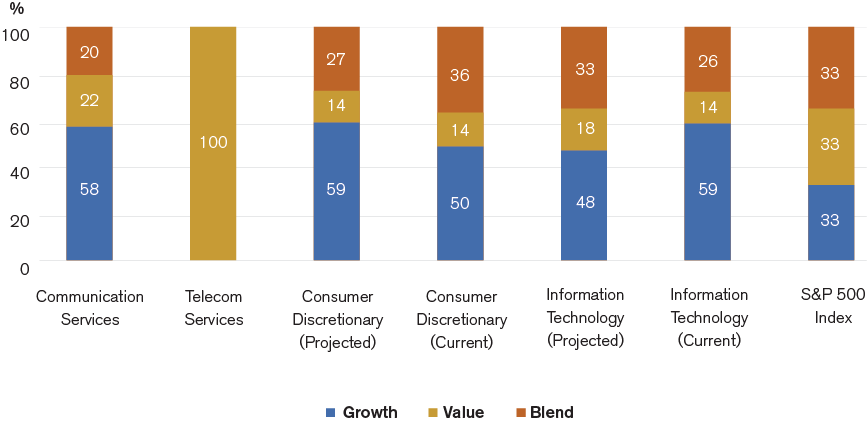

• In recent years, investors have viewed Telecom stocks as defensive equities given their high dividend payments and relative stability. Most phone companies now operate like utilities. However, the new Communication Services sector will certainly be more cyclical in nature due to the addition of growth-oriented stocks from the Tech and Consumer Discretionary sectors. Investors who buy a new Communication Services sector ETF should expect a more growth-oriented and volatile ride (See Figure 2) and should no longer view this sector as a bond proxy. The dividend yield of the new sector is expected to be less than 2%, compared to more than 5% for the current Telecom sector.

• Similarly, many investors who use a quantitative approach to invest in sectors will need to revisit their methodology as the sectors included in their historical backtests are no longer representative going forward.

• Finally, after enjoying an incredibly strong run of performance, many tech companies are becoming more and more concerned about the potential for regulation on the horizon. The inclusion of certain tech companies into the new Communication Services sector seemingly only makes it tougher to argue that they should not be regulated by the Federal Communications Commission. Tech companies that are added to the Communication Services sector may find this to be an additional headwind.

At SEIA, we have adjusted our due diligence approach and portfolio construction processes to accommodate these major changes and will continue to look for opportunities that result for the benefit of our clients.

Third Party Site

The information being provided is strictly as a courtesy. When you link to any of the websites provided here, you are leaving this website. We make no representation as to the completeness or accuracy of information provided at these websites. Nor is the company liable for any direct or indirect technical or system issues or any consequences arising out of your access to or your use of third-party technologies, websites, information and programs made available through this website. When you access one of these websites, you are leaving our web site and assume total responsibility and risk for your use of the websites you are linking to.

Dated Material

Dated material presented here is available for historical and archival purposes only and does not represent the current market environment. Dated material should not be used to make investment decisions or be construed directly or indirectly, as an offer to buy or sell any securities mentioned. Past performance cannot guarantee future results.