The Complexity of Interest Rates: Beyond the Fed’s Decisions

By Gene Balas, CFA®

Investment Strategist

Investors may see the current environment as a time to “lock in” a fixed income investment at current interest rates based on the belief that the Federal Reserve will soon lower interest rates. But it’s more complicated than that. When discussing interest rates, we must first define which interest rates we are referring to.

The Federal Reserve controls the very short-term rates that dictate the overnight interest rates for banks’ lending to each other. It is these short-term rates that are reflected in what investors receive in bank savings accounts and other short-term instruments, including some money market funds and certain other products. These rates are influenced by Fed decisions.

However, longer-term interest rates for securities with maturities from anywhere from a few months duration out to 30 years or so are determined by investors’ decisions to buy or sell bonds on the open market. These rates are not controlled by the Fed, but rather by supply and demand in the financial markets.

The Fed lowering short term rates doesn’t necessarily mean that longer-term rates will also fall. Instead, the federal government’s fiscal policies play a big role in determining the supply of bonds for sale. More supply of Treasury bonds with the same amount of demand for these bonds may cause longer-term interest rates to rise and prices of those bonds to fall.

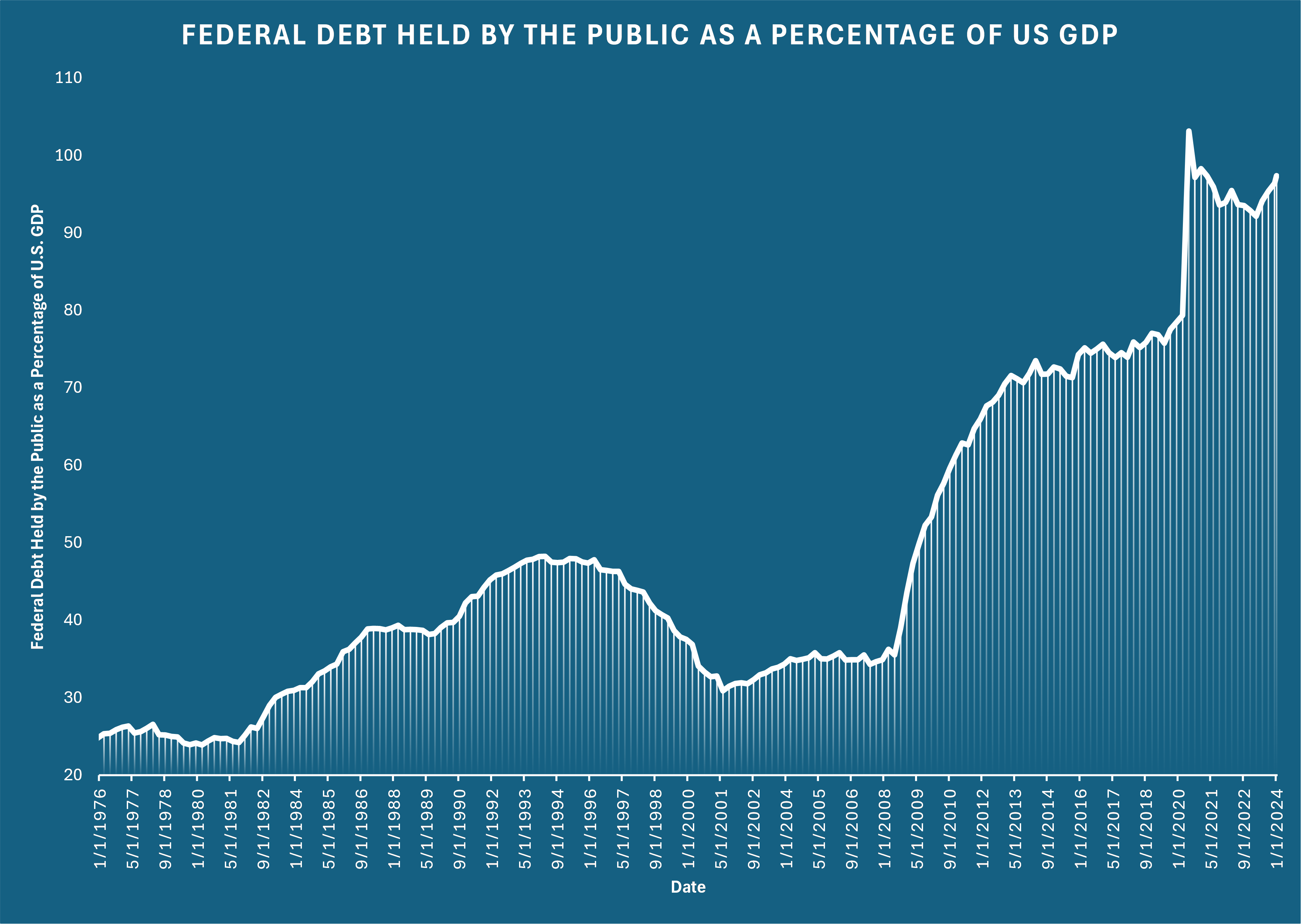

Indeed, if the president and members of Congress increase the size of the federal budget deficit through some combination of lower taxes and/or more government spending, then investors may demand higher interest rates (and lower bond prices) to absorb the greater supply of newly issued bonds. Consider the nearby graph that illustrates the growth of the federal budget deficit as a percentage of the U.S. economy (as measured by Gross Domestic Product, or GDP) over time.

Source: Source: Federal Reserve Bank of St. Louis

Thus, the Fed can cut the rates it controls for very short-term lending while longer-term interest rates can simultaneously increase. This is especially true if the market believes that the Fed cutting rates prematurely could be inflationary, causing investors to demand a higher yield for holding longer term bonds. The rates on Treasury bills, notes, and bonds affect a multitude of interest rates in the market, from auto loans to mortgage rates to corporate bond yields.

There is also the risk that inflation doesn’t meaningfully converge towards the Fed’s 2% target soon. If inflation remains elevated, the Fed may keep rates at their current levels for longer than investors currently anticipate. Betting on the direction of interest rates is therefore a bit more complicated than simply assuming the Fed will cut rates in the very near future.

When deciding how to “lock in” an interest rate on one’s investment, the direction of interest rates depends on much more than Federal Reserve policy. Interest rates on longer term bonds are also determined by the actions of politicians as well as supply and demand factors in the bond market– not just by the actions of Fed officials. That is in addition to myriad market and economic indicators, such as relating to inflation and economic growth, as well as even currency fluctuations.

That being the case, it is not at all clear that longer term interest rates will necessarily head lower—even if the Fed cuts the short-term rates it controls. The topic of interest rates is far more complicated than simply a Fed decision, and your investment strategy needs to reflect careful, thoughtful consideration of all variables involved.

Rather than trying to guess where interest rates – that includes interest rates on everything from savings accounts and money market funds to intermediate- and longer-term bonds – in addition to factoring in other important variables, such as credit risk of corporate or mortgage-backed bonds, consider an actively managed bond portfolio. Professional portfolio managers have extensive resources, including research from analysts and economists as well as sophisticated financial analytics tools that are not available to the general public.

At SEIA, we actively manage fixed income strategies, constructed with active funds and individual bonds, customized to each investor’s preferences. Talk to your SEIA financial advisor to learn more about our fixed income portfolio management services and how they can benefit your objectives.

Economic and market data can change instantly as news flows and economic data are released continuously. Staying on top of the markets and being prepared to manage portfolios quickly is why professional portfolio management is essential – not trying to lock in interest rates based simply on focusing on only Federal Reserve meetings.

The information contained herein is for informational purposes only and should not be considered investment advice or a recommendation to buy, hold, or sell any types of securities. Investing in securities carries a risk of loss, including the potential loss of principal. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be profitable or suitable for a particular investor’s financial situation or risk tolerance. The information contained herein was carefully compiled from sources SEIA believes to be reliable, but we cannot guarantee the accuracy or completeness of the information provided. Past performance does not guarantee future results. For details on the professional designations displayed herein, including descriptions, minimum requirements, and ongoing education requirements, please visit seia.com/disclosures. Signature Estate & Investment Advisors, LLC (SEIA) is an SEC-registered investment adviser; however, such registration does not imply a certain level of skill or training and no inference to the contrary should be made. Securities offered through Signature Estate Securities, LLC member FINRA/SIPC. Investment advisory services offered through SEIA, 2121 Avenue of the Stars, Suite 1600, Los Angeles, CA 90067, (310) 712-2323.

Third Party Site

The information being provided is strictly as a courtesy. When you link to any of the websites provided here, you are leaving this website. We make no representation as to the completeness or accuracy of information provided at these websites. Nor is the company liable for any direct or indirect technical or system issues or any consequences arising out of your access to or your use of third-party technologies, websites, information and programs made available through this website. When you access one of these websites, you are leaving our web site and assume total responsibility and risk for your use of the websites you are linking to.

Dated Material

Dated material presented here is available for historical and archival purposes only and does not represent the current market environment. Dated material should not be used to make investment decisions or be construed directly or indirectly, as an offer to buy or sell any securities mentioned. Past performance cannot guarantee future results.