Navigating the Potential US Government Shutdown

By Gene Balas, CFA®

Investment Strategist

Executive Summary

-

- The potential for a federal government shutdown is increasing. If Congress fails to ratify spending bills by September 30, many federal agencies face closure on October 1.

- Historically, government shutdowns have not triggered major market disruptions, but they can increase volatility.

- Economic effects depend on the shutdown’s duration, with temporary impacts expected.

What Is at Stake with a Possible Government Shutdown?

The U.S. is hurtling towards a possible shutdown of the federal government, currently because of divisive battles within the GOP in the House of Representatives, about the extent to which government spending should be cut when the government’s new fiscal year begins October 1. If Congress does not ratify bills authorizing spending by September 30, then many of the agencies of the federal government will shut down on October 1.

Add to this the complications that whatever bill that passes the Republican-held House of Representatives must also pass the Senate, where Democrats have a slim majority. Bipartisan negotiations might offer the best approach, but currently, the GOP is engaged in internecine disputes between party hardliners and those who may be more willing to compromise with Democrats to draft a bill that can pass both parties, hopefully with bipartisan (even if nowhere near unanimous) support.

With that in mind, the deadline to pass legislation is quickly approaching before “non-essential” government services will come to a halt. Each federal government agency makes its own contingency plan for operating “essential” services during a government shutdown. Employees in key roles—air traffic controllers, border security agents, military personnel, the Postal Service and many more—would continue to work, though paychecks may be delayed. Non-essential services, however, will be paused. In the 2018-2019 shutdown, an estimated 850,000 federal workers were furloughed.

Non-essential government functions would stop during a shutdown. In past shutdowns, the closure of national parks and the Smithsonian museums has been among the most high-profile impacts. The processing of passport and Social Security applications would be suspended, though Social Security and other benefits would continue to be paid out.

We hope that politicians can reach an agreement soon to fund the U.S. government. But even if politicians don’t reach an agreement before the end of this fiscal year on September 30, investors may find that the lasting effects of a government shutdown may not be as large as feared (at least with the passage of a bit of time after the government eventually reopens).

What are the implications to investors?

Historically, government shutdowns have not caused a major reaction in the markets. In fact, the S&P 500 has risen during the last five government shutdowns. But shutdowns can increase market volatility. In the 2018-2019 shutdown, the S&P 500 dropped by 2.7% on the first trading day after the shutdown, rebounded nearly 5% on the next trading day and was up more than 10% by the end of the 35-day shutdown, according to Charles Schwab.

To capture the market returns leading up to and then following the 2018 government shutdown, for the 2018 calendar year, the Russell 1000 lost 4.78% for the 2018, only to make those losses back – and then some – in the following year, when the index posted a 31.43% advance in the 2019 calendar year, in data according to FactSet.

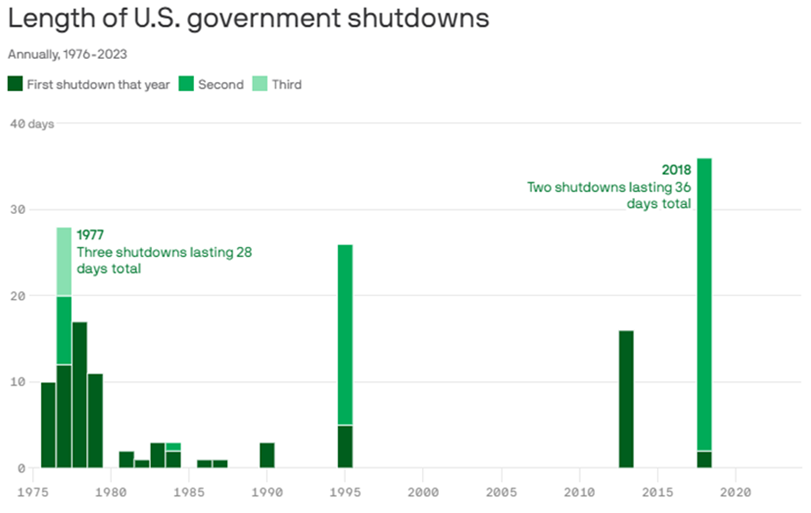

Aside from the market reaction, the economic effects depend on how long any shutdown might last. However, in the nearby graph depicting the government shutdowns in the past few decades and their frequency and duration, you may note that none of the government shutdowns in the past thirty years was associated with a period in which the U.S. economy was in a recession. That doesn’t mean, though, that a government shutdown wouldn’t dent U.S. economic growth. Many economists argue that it will, though the effects might not be permanent and would be partially made up when the government eventually reopens.

What is the likelihood of a government shutdown?

Data: U.S. House of Representatives; Note: Shutdowns are attributed to the year in which they started; Chart: ErinDavis/Axios Visuals

Research group Strategas assigns a 75% probability to a government shutdown on October 1st They also noted that, “House Speaker Kevin McCarthy made the decision to vote repeatedly throughout [last] weekend until something passed, with the idea that a House Republican bill could at least set up some negotiation with the Senate.”

House Republicans were unable to get bills passed and lawmakers were sent home for the weekend. With no action through the weekend, House Republicans can try again this week, but this strategy leaves little time for the Senate to clear through procedural hurdles by September 30th.

What Are the Economic Ramifications?

There are two main economic ramifications from a government shutdown. One is the direct and indirect effects of the shutdown itself. The second is the possibility of the U.S. losing its remaining top credit rating of Aaa by Moody’s, with Fitch and Standard & Poor’s having already downgraded the U.S.

As to the economic effects, Goldman Sachs economists estimate that a “government-wide shutdown would reduce quarterly annualized growth by around 0.20 percentage points (pp) for each week it lasted, reflecting a 0.15pp direct effect from reduced federal consumption and a 0.05pp indirect effect from spillovers to private sector activity. Our baseline is that a shutdown could last for 2-3 weeks.”

Goldman adds, “Leaders of both chambers support a temporary extension after the end of the fiscal year on Sep. 30, and potential emergency funding requests raise the odds that Congress passes at least one extension before any shutdown.”

Bloomberg also estimates a government shutdown would produce a drag of 0.2 percentage point on annualized quarterly GDP growth for each week that it lasts — followed by a reversal once funding is restored. In an extreme tail event, the maximum hit to 4Q GDP would be a drag of 2.8 ppts if the shutdown lasts for the entire quarter.

Considering that the current Bloomberg survey median sees just 0.4% GDP growth for 4Q, a shutdown that lasts all quarter would push 4Q growth deep into negative territory. However, past shutdowns have, on average, been much shorter. The eight government shutdowns since 1982 have lasted an average of two weeks. The longest one — in 2018 — lasted five weeks, according to Bloomberg.

Assuming a two-week duration as Bloomberg’s baseline, the shutdown will knock 0.5 ppt off annualized quarterly GDP growth while it’s ongoing, and raise the unemployment rate by 0.1% ppt in October. The effects will mostly reverse within 4Q once the funding stalemate is resolved, but forgone economic activity and the uncertainty from the shock could produce a net drag of 0.1 ppt on 4Q GDP, Bloomberg notes.

Still, to create a significant drag on growth, business and consumer confidence would have to fall to such a degree that companies start curtailing new hiring and capex projects, and consumers significantly cut spending on discretionary items — a tail-event scenario that’s not Bloomberg’s baseline scenario.

That said, small businesses are indeed concerned. Conducted independently of Goldman’s own research, Goldman also surveys small businesses about economic topics, in its “10,000 Small Businesses Voices” survey of small business owners.

A nearly unanimous 91% of small business owners surveyed said it’s important for the federal government to avert a government shutdown.

Among the 70% of small business owners who say they will be negatively impacted by a government shutdown, the survey results find the effects on small businesses would be:

- 93% believe their revenue would take a hit as a result,

- 67% said their customer demand would go down due to economic uncertainty and instability,

- 24% rely on Small Business Administration services, including loans and support,

- 21% are federal contractors or subcontractors, and

- 21% said their customers are often government employees and their revenue would be impacted.

How Might the Credit Quality of the U.S. Be Affected?

The second, unrelated potential ramification of a government shutdown is for Moody’s – the last major rating agency yet to have downgraded the US’s debt – to consider cutting the U.S. credit rating from Aaa, leaving the U.S. without a top rating from any of the three major rating agencies, with Fitch having downgraded the U.S. recently, while Standard & Poor’s downgraded the U.S. debt years ago – also due to a government disfunction at the time, citing the U.S.’s governance abilities in passing budgets and funding its programs.

Moody’s perhaps sums up the situation best: it notes that a shutdown would “underscore the weakness of US institutional and governance strength relative to other AAA-rated sovereigns” and show “the significant constraints that intensifying political polarization put on fiscal policymaking at a time of declining fiscal strength, driven by widening fiscal deficits and deteriorating debt affordability”.

Conclusion

We believe investors would be well served to keep the potential government shutdown in context. While it’s certainly a potential market factor; it’s far from the only one. Rather than politics, it’s our contention that the outlook for corporate earnings, economic growth, and monetary policy will have a significantly greater influence on the performance of financial markets.

While we all may be subjected to watching this political drama play out over the coming weeks, there’s no reason to believe it should warrant any major changes to your portfolio. In the meantime, however, if you have specific questions or concerns regarding the debt ceiling and its potential impact on your current investment strategy, please don’t hesitate to talk with your SEIA advisor.

The information contained herein is for informational purposes only and should not be considered investment advice or a recommendation to buy, hold, or sell any types of securities. Financial markets are volatile and all types of investment vehicles, including “low-risk” strategies, involve investment risk, including the potential loss of principal. Past performance does not guarantee future results. For details on the professional designations displayed herein, including descriptions, minimum requirements, and ongoing education requirements, please visit seia.com/disclosures. Signature Estate & Investment Advisors, LLC (SEIA) is an SEC-registered investment adviser; however, such registration does not imply a certain level of skill or training and no inference to the contrary should be made. Securities offered through Signature Estate Securities, Inc. member FINRA/SIPC. Investment advisory services offered through SEIA, 2121 Avenue of the Stars, Suite 1600, Los Angeles, CA 90067, (310) 712-2323.

Third Party Site

The information being provided is strictly as a courtesy. When you link to any of the websites provided here, you are leaving this website. We make no representation as to the completeness or accuracy of information provided at these websites. Nor is the company liable for any direct or indirect technical or system issues or any consequences arising out of your access to or your use of third-party technologies, websites, information and programs made available through this website. When you access one of these websites, you are leaving our web site and assume total responsibility and risk for your use of the websites you are linking to.

Dated Material

Dated material presented here is available for historical and archival purposes only and does not represent the current market environment. Dated material should not be used to make investment decisions or be construed directly or indirectly, as an offer to buy or sell any securities mentioned. Past performance cannot guarantee future results.