Market Update: Volatility is Normal

By Deron T. McCoy, CFA®, CFP®, CAIA®

Chief Investment Officer

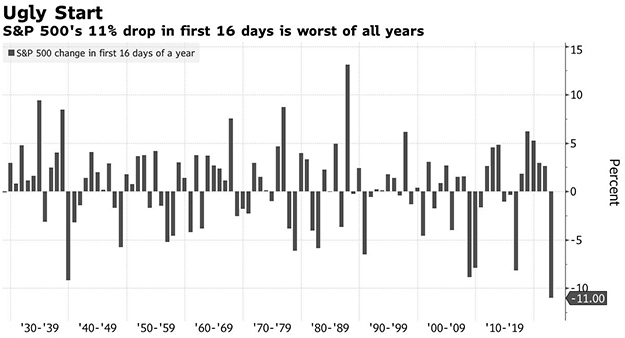

It was just three weeks ago that markets were trading at all-time highs. The S&P 500® closed January 3rd at 4796 and hit an intraday high the following day at 4818. Just 16 trading days into 2022, however, the S&P 500 has now dropped 11% (it’s the worst start to a year—ever—according to Bloomberg)!

Source: Bloomberg

Why? Well, there’s certainly plenty to worry about—including, but not limited to, Covid, Supply Chains, Inflation, the Federal Reserve, Valuations, and excessive margin/leverage (not to mention the upcoming midterm elections as well as geopolitical concerns in Russia and China). Whew! The list is exhausting.

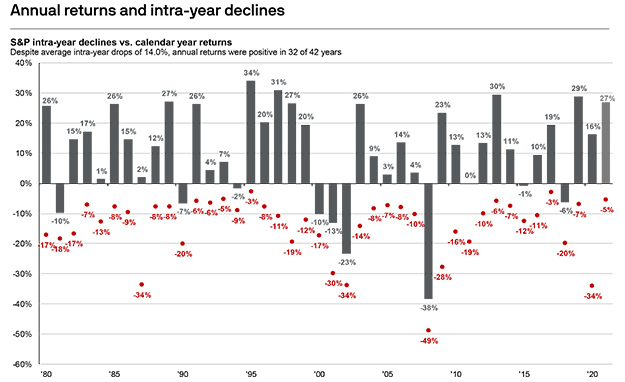

Not surprisingly, global capital markets are reacting. But this is in fact normal; not abnormal. According to JPMorgan, since 1980 intra-year declines have averaged -14%. Yet despite this volatility, the gains have far outpaced the losses and thus the average annual return was +9.4%. Stocks go up, stocks go down—it’s what they do. Volatility is simply the price investors must pay to reap outsized returns.

Source: FactSet, Standard & Poor’s, J.P. Morgan Asset Management. Returns are based on price index only and do not include dividends. Intra-year drops refer to the largest market drops from a peak to a trough during the year. For illustrative purposes only. Returns shown are calendar year returns from 1980 to 2021, over which time period the average annual return was 9.4%. Guide to the Markets – U.S. Data as of December 31,2021.

Although history suggests that markets can certainly go lower, it’s important to remember that real long-term wealth is often generated in these times of stress. Intestinal fortitude and a good financial plan can help ensure that you don’t sell (or are forced to sell) at the bottom; but instead have the means to take advantage of volatility—seeking out opportunities in the weeks and months ahead.

The information contained herein is for informational purposes only and should not be considered investment advice or a recommendation to buy, hold, or sell any types of securities. Financial markets are volatile and all types of investment vehicles, including “low-risk” strategies involve investment risk; Past performance does not guarantee future results. Indexes cannot be invested in directly, are unmanaged, and do not incur management fees, costs, and expenses. For details on the professional designations displayed herein, including descriptions, minimum requirements, and ongoing education requirements, please visit www.seia.com/disclosures.

Signature Estate & Investment Advisors, LLC (SEIA) is an SEC-registered investment adviser; however, such registration does not imply a certain level of skill or training and no inference to the contrary should be made. Securities offered through Royal Alliance Associates, Inc. member FINRA/SIPC. Investment advisory services offered through SEIA, 2121 Avenue of the Stars, Suite 1600, Los Angeles, CA 90067, (310) 712-2323. Royal Alliance Associates, Inc. is separately owned and other entities and/or marketing names, products, or services referenced here are independent of Royal Alliance Associates, Inc.

Third Party Site

The information being provided is strictly as a courtesy. When you link to any of the websites provided here, you are leaving this website. We make no representation as to the completeness or accuracy of information provided at these websites. Nor is the company liable for any direct or indirect technical or system issues or any consequences arising out of your access to or your use of third-party technologies, websites, information and programs made available through this website. When you access one of these websites, you are leaving our web site and assume total responsibility and risk for your use of the websites you are linking to.

Dated Material

Dated material presented here is available for historical and archival purposes only and does not represent the current market environment. Dated material should not be used to make investment decisions or be construed directly or indirectly, as an offer to buy or sell any securities mentioned. Past performance cannot guarantee future results.