Greed vs Fear

By Sam Miller, CFA®, CFP®, CAIA®

Senior Investment Strategist

Throughout history, markets have a tendency to be driven by varying degrees of greed or fear. In recent days, the pendulum has swung far to the side of fear, based on continued headlines of COVID-19’s lack of containment and disagreement between Saudi Arabia and Russia over oil output, driving a fall in oil prices by almost 30% in one day. Those headlines have spurred a correction and are driving markets into unprecedented territory, with the entire US Treasury yield curve now below 1% for the first time ever.

What’s Happening?

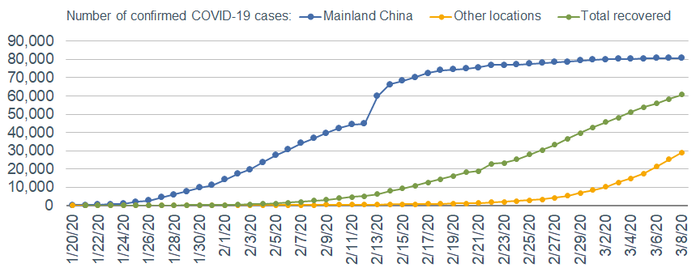

With coronavirus fears rampant and widespread uncertainty over the economic repercussions, markets could continue to move lower in the near term. While confirmed COVID-19 cases in mainland China have begun to flatten out, cases outside China’s border have begun to accelerate (see below). Because of this, markets will likely remain at the mercy of virus news for the foreseeable future.

Source: Charles Schwab, Johns Hopkins’ Center for Systems Science and Engineering as of 3/8/2020

Source: Charles Schwab, Johns Hopkins’ Center for Systems Science and Engineering as of 3/8/2020

Beyond COVID-19, an all-out price war between major oil suppliers is adding to the volatility, with WTI crude futures dropping below $30 on March 9th. This could put pressure on corporate credit in coming weeks and months, especially since energy companies are the largest issuers of riskier “junk” bonds.

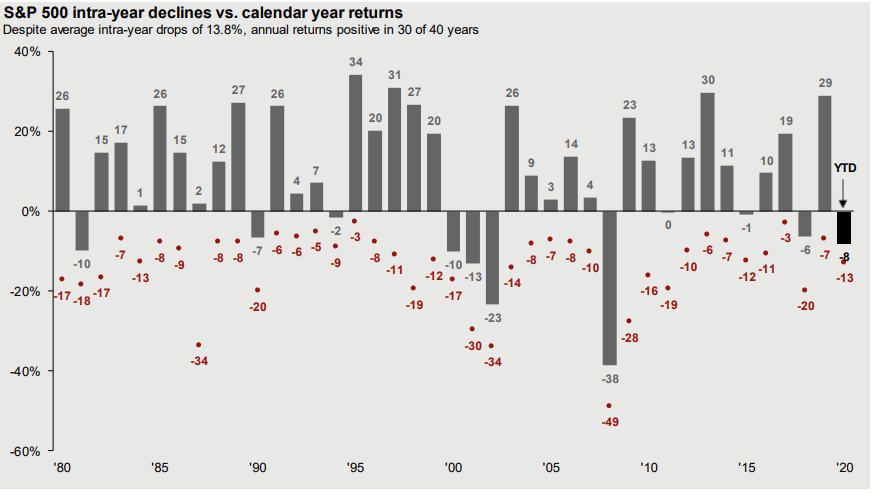

At this point, the S&P 500 has officially reached “correction” territory, down more than 17% from recent all-time highs. Putting things in perspective, keep in mind that corrections during this bull market (starting March 2009) have lasted an average of 78 calendar days and saw an average decline of nearly 15%. Looking back further (since 1990), the average correction has averaged a decline of almost 19% over an average span of 83 days.[1]

Source: FactSet, Standard & Poor’s, JPMorgan Asset Management as of 3/6/2020

Source: FactSet, Standard & Poor’s, JPMorgan Asset Management as of 3/6/2020

While markets could certainly fall further in coming weeks and months, there is reason for optimism. The world’s major banking institutions that manage the underlying plumbing of markets are far better positioned to weather a shock today than they were in 2008. Large banks are less than half as leveraged as they were in 2008.[2]

What To Do Now?

Our advice from last year’s “Late Cycle Toolkit” generally remains the same. That advice included: letting your plan dictate your asset allocation, getting off margin, keeping a couple year’s worth of cash on the sideline, diversifying across asset classes and styles, and rebalancing in a rules-based systematic fashion. Times like these are a great opportunity to refocus on the reason you’re investing in the first place. Whether it’s funding your retirement goals or providing stability for future generations, corrections can provide great opportunities for long-term, patient investors. Now might be an ideal time to consider increasing your retirement or college funding contributions with prices 15-20% lower than they were a few weeks ago. But, during volatile markets, sometimes what you don’t do can be more important than what you do:

- Think twice before attempting to time markets

- Avoid binary “all-in or all-out” strategies. Investing is a gradual process over time.

- Don’t panic. Don’t throw out your long-term plan by locking in losses today to flee to an asset class that yields next to nothing.

We will continue to monitor developments in the economic landscape and respond to opportunities that arise. While we may be in for a bumpy road with COVID-19, oil markets, upcoming US elections, and other unforeseen developments, corrections are a normal part of the ebb and flow of financial markets. Our disciplined investing process aims to ensure your long-term success through diversification.

[1] Bespoke Investment Group

[2] Financial Stability Board

Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss. Past performance is no guarantee of future results. Please note that individual situations can vary. Therefore, the information presented here should only be relied upon when coordinated with individual professional advice. Securities offered through Royal Alliance Associates, Inc. member FINRA/SIPC. Investment advisory services offered through SEIA, LLC, 2121 Avenue of the Stars, Suite 1600, Los Angeles, CA 90067, (310) 712-2323. Royal Alliance Associates, Inc. is separately owned and other entities and/or marketing names, products or services referenced here are independent of Royal Alliance Associates, Inc.

Third Party Site

The information being provided is strictly as a courtesy. When you link to any of the websites provided here, you are leaving this website. We make no representation as to the completeness or accuracy of information provided at these websites. Nor is the company liable for any direct or indirect technical or system issues or any consequences arising out of your access to or your use of third-party technologies, websites, information and programs made available through this website. When you access one of these websites, you are leaving our web site and assume total responsibility and risk for your use of the websites you are linking to.

Dated Material

Dated material presented here is available for historical and archival purposes only and does not represent the current market environment. Dated material should not be used to make investment decisions or be construed directly or indirectly, as an offer to buy or sell any securities mentioned. Past performance cannot guarantee future results.