ESG Trends in the Time of COVID-19

By Josh Woodard, CFA®

Research Analyst

As is the case with nearly every business around the world, COVID-19 will certainly have a lasting impact on the investment industry. And one potentially huge beneficiary of these changes will be the area of Environmental, Social, and Governance (ESG) investing. ESG is a style of investing that focuses on owning companies that demonstrate good corporate citizenship and behaviors such as a reduced carbon footprint (E), fair labor practices (S), and diversified boards of directors (G). The global pandemic has highlighted some serious discrepancies between companies that do right by their stakeholders and those who do not. For example, Home Depot spent $850 million to prioritize safety and enhance employee benefits during this time, while other firms like Kroger maintained restrictive sick leave policies and had to walk back requests (after public backlash) for some employees to return overpaid funds.

Thanks to a decade’s worth of research and data analysis which shows that companies scoring highly on ESG factors tend to outperform their peers who score lower, the ESG investment framework has picked up considerable attention and momentum. Data will continue to improve in this space as more investors seek quantifiable metrics to screen their investments and to understand how their current portfolio scores in relation to their own personal values. As this data library grows, identifying ESG issues should also become easier. John Streuer, CEO of responsible investing firm Calvert, recently said that “his company will call on businesses to publicly disclose the racial makeup and compensation of their employees” – a positive step towards helping uncover and address racial inequality amidst protests taking place all across America in the aftermath of the George Floyd killing.

Asset managers and research providers remain committed to improving transparency in the space. In April, Morningstar acquired Sustainalytics, a leader in ESG ratings and research. MSCI, one of the largest index providers, has also become the world’s largest ESG index and research provider – continuing to improve their ESG infrastructure as market appetite grows. Technology is the key driver for improved ESG metrics, as AI combined with millions of data points will serve to strengthen and refine investment decisions in this area. The future of ESG investing continues to point to highly customizable options for investors since personal beliefs are rarely if ever “one-size-fits-all.”

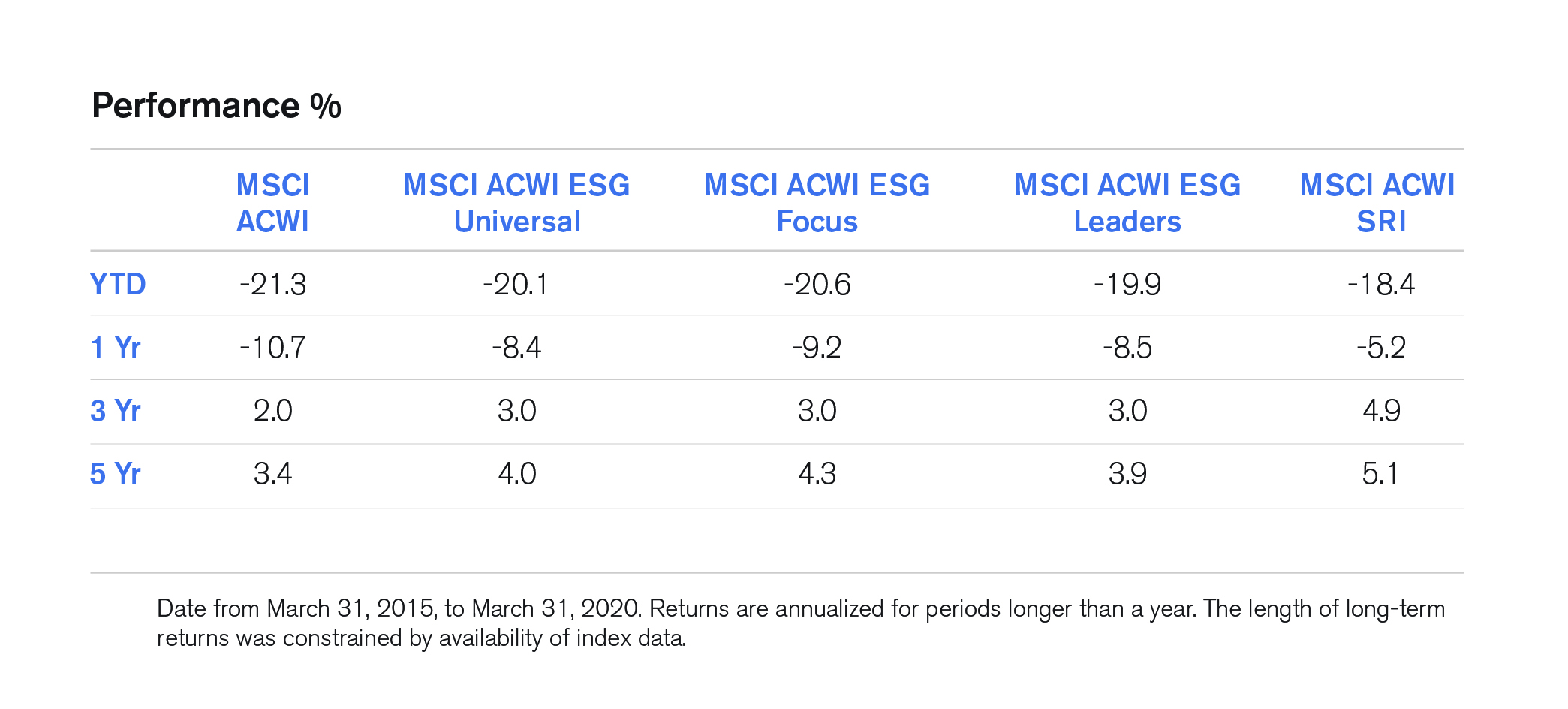

Over the last two years, many ESG portfolios have beaten traditional benchmarks. During the market downturn, Morningstar found that ESG funds delivered some of the best returns within their respective categories – outperforming their conventional brethren. So far in 2020, this continues to be true, as all six MSCI indexes with ESG objectives outperformed the market in Q1.

Will the ESG trend continue?

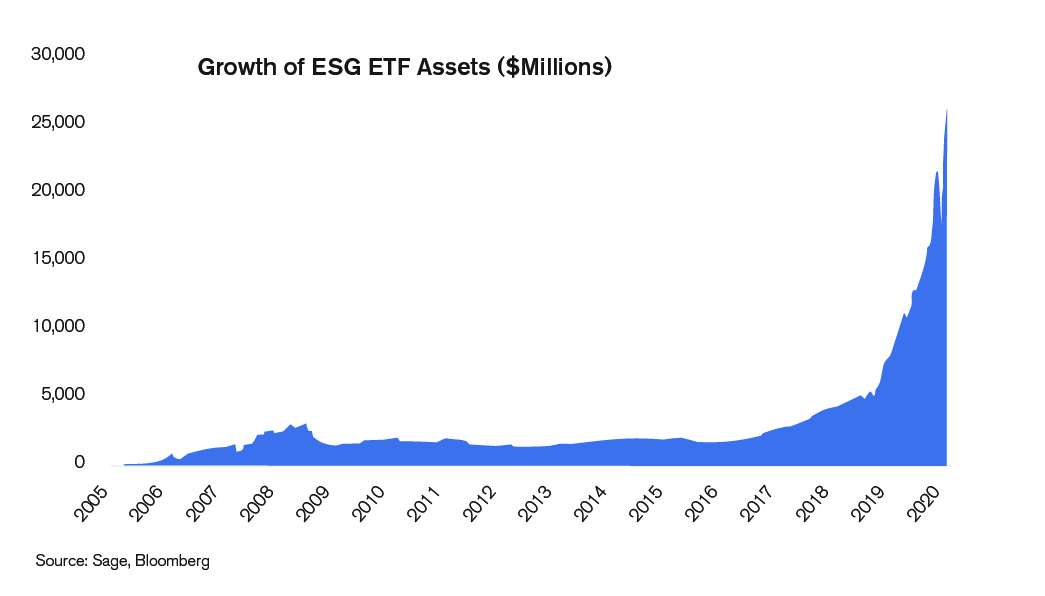

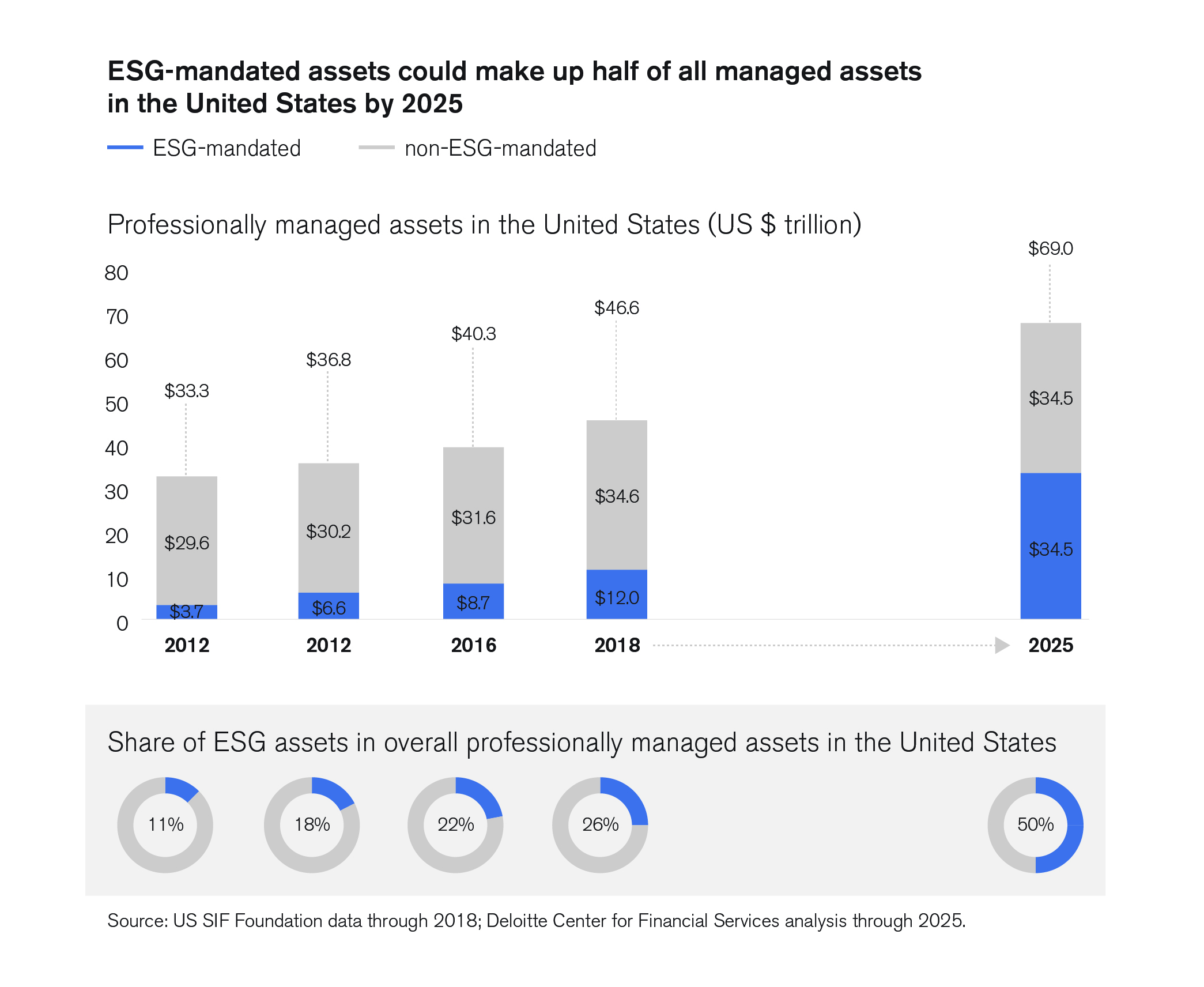

Based on both asset flows and performance, it’s safe to say that ESG investing isn’t just a fad. According to Morningstar, U.S. investors poured $20.6 billion into sustainable funds in 2019 alone. And ESG asset flows have doubled from Q1 2019 to Q1 2020. In fact, Deloitte estimates that by 2025, half of all managed assets in the U.S. will be ESG mandated.

The great wealth transfer from Baby Boomers to Millennials should provide continued ESG support. More than $30 trillion is expected to be passed down over the coming decades, with millennial beneficiaries far more interested in ESG investment strategies than previous generations. According to MSCI, 88% of high net worth millennials are actively reviewing the ESG impact of their portfolio, with 57% of them having intentionally stopped investing or declined to invest in a company due to its ESG metrics. These same people view their consumer activities through the same lens; buying goods and services from companies that have an ethical reputation, or brands that they believe in. Not only will the future holders of capital care more about these issues, but as younger politicians continue rising through the ranks of government, they will likely pass policies that buoy the ESG framework.

Asset managers are keenly aware of this growing wave of interested investors. In a letter penned to investors in January of this year, BlackRock, the world’s largest asset manager, said that they are putting sustainability at the center of their investment strategy. In the letter, the firm indicated that they will immediately cease to invest in companies that “present a high sustainability-related risk.” These types of initiatives by both asset managers and investors present serious headwinds for non-sustainable companies, as capital flees from old-world non-ESG companies and flows into businesses that are both sustainable and well-positioned for the future.

Numerous studies have shown that the cost of capital for responsible corporations is cheaper than for those who are not. Capital will continue to flow to companies that do right by their stakeholders and have an ESG framework in mind. Savvy corporate leaders clearly understand this paradigm shift and the need to stay ahead of it to thrive. They know the perception of their ESG programs help them maintain a good reputation which in turn makes it easier to attract and retain both talented professionals and customers. In January, Microsoft announced that by 2030 the firm will be carbon negative, and that by 2050 they will have removed all carbon they ever emitted since they were founded in 1975.

Aside from the capital flows to this space, some of the developments in renewable energy technology are incredibly exciting. According to Bloomberg New Energy Finance (BNEF), solar and onshore wind are now the cheapest sources of new-build generation for two-thirds of the world’s population. At the same time, battery storage prices continue to fall as capacity capabilities increase while the price to charge these batteries decreases. By 2030, McKinsey estimates that wind and solar will be cheaper than existing coal or gas plants in nearly every country. And for the first time in 134 years, 2019 saw the U.S. consume more renewables than coal.

Whether acting as consumers or investors, people today care a great deal more about the companies that they align with. Luckily, it’s never been easier to allocate your portfolio in accordance with your values. ESG investing has stood its ground in 2020, and there’s a great deal of exciting momentum that should continue driving the framework of “doing well by doing good” far into the future.

Sources:

1 Accenture. The “Greater” Wealth Transfer – Capitalizing on the Intergenerational Shift in Wealth, 2012: https://www.accenture.com/us-en/insight-capitalizing-intergenerational-shift-wealth-capital-markets-summary

2 Bank of America. 2018 Insights on Wealth and Worth

3 Allianz ESG Investor Sentiment Study 2019

4 Allianz ESG Investor Sentiment Study 2019

5 Morgan Stanley Institute for Sustainable Investing: Sustainable Signals — The Individual Investor Perspective (2019)

6 Morgan Stanley Institute for Sustainable Investing: Sustainable Signals — The Individual Investor Perspective (2019)

Advancing environmental, social, and governance investing

U.S. Consumed More Renewables Than Coal for First Time in 134 Years

Electric Vehicle Outlook 2020

European ESG Funds Pulled in Record $132 Billion in 2019

Home Depot hit with $850M coronavirus-related charge

Out of pandemic crisis, what could a new New Deal look like?

Microsoft Says Covid-19 Had Minimal Impact On Revenue In Its Latest Quarter. Its Stock Is Rising.

‘Trolls World Tour’ made more for Universal in 3 weeks on demand than ‘Trolls’ did in 5 months in theaters

Top 10 ESG Trends for the New Decade

Microsoft will be carbon negative by 2030

U.S. ESG Funds Outperformed Conventional Funds in 2019

BlackRock CEO says sustainability is the ‘top issue’ for investors—here’s what that means for your money

Sustainable Fund Flows in 2019 Smash Previous Records

Scale-up of Solar and Wind Puts Existing Coal, Gas at Risk

Does Corporate Social Responsibility Affect the Cost of Capital?

Calvert CEO Says Ending Racism Is a Responsibility of Businesses

Third Party Site

The information being provided is strictly as a courtesy. When you link to any of the websites provided here, you are leaving this website. We make no representation as to the completeness or accuracy of information provided at these websites. Nor is the company liable for any direct or indirect technical or system issues or any consequences arising out of your access to or your use of third-party technologies, websites, information and programs made available through this website. When you access one of these websites, you are leaving our web site and assume total responsibility and risk for your use of the websites you are linking to.

Dated Material

Dated material presented here is available for historical and archival purposes only and does not represent the current market environment. Dated material should not be used to make investment decisions or be construed directly or indirectly, as an offer to buy or sell any securities mentioned. Past performance cannot guarantee future results.