Avoiding the Tax Tail Trap

By Sam Miller, CFA®, CAIA®, CFP® , Senior Investment Strategist

As a wealth management firm with many clients residing in the state of California as well as other high tax states around the country, we are acutely aware of the bite that taxes can take out of portfolio returns. Because of this, we use every tool in our tax toolkit to help mitigate your tax burden and avoid paying more than your fair share to Uncle Sam. Whether it’s tax-advantaged accounts like IRAs and 529s, tax-free muni bonds, proactive tax loss harvesting strategies, private vehicles such as qualified opportunity zones and exchange funds, or sophisticated estate planning techniques, there are many strategies available to pursue the goal of tax minimization.

It’s important to note, however, that there is such a thing as too much tax minimization, especially when it leads to bad investor behavior that can result in a suboptimal investment portfolio. Just like everything else in life, there are tradeoffs and limits to consider when it comes to reducing your tax liability. And there are many reasons to avoid the trap of “letting the tax tail wag the investment dog.”

Undiversified portfolios carry unnecessary risks

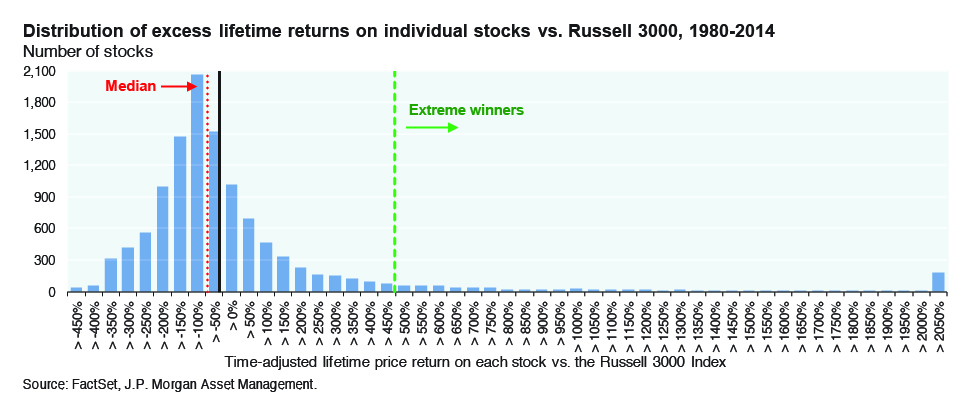

After an extended bull market, where certain stocks and sectors rose more than others, many portfolios have shifted out of balance and become undiversified, taking on more risk than is prudent. Without periodic rebalancing, even diversified* portfolios have drifted up the risk spectrum into new territory. But let’s just focus on the risks of individual stocks for now. Over the long run, some companies substantially outperform the market and maintain their value over time, but those are few and far between (Figure 1). Before deciding to hold onto those outsized winners forever, consider the facts. The odds are stacked against most investors who hold concentrated stock positions indefinitely. A small handful of stocks typically drives returns for the overall market, and the vast majority of US stocks actually underperform the Russell 3000 over the course of their lifetimes (Figure 1).

Figure 1:

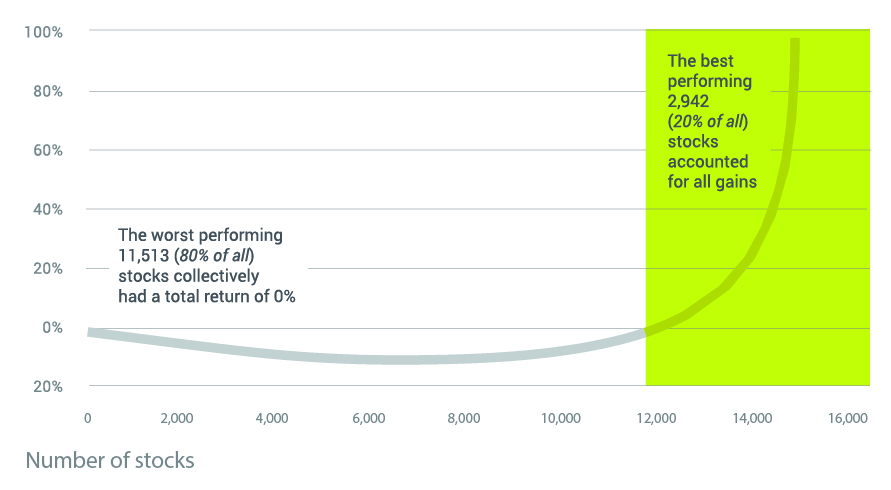

In fact, the worst performing 80% of US stocks from 1989-2015 had a 0% collective total return. It would be grossly optimistic and more than a bit naïve to think that your concentrated stock holding is in this small universe of winners. In most cases, investors may have been better off holding a more diversified basket of securities.

Figure 2: Attribution of collective return, 1989-2015

Source: Longboard Funds

Source: Longboard Funds

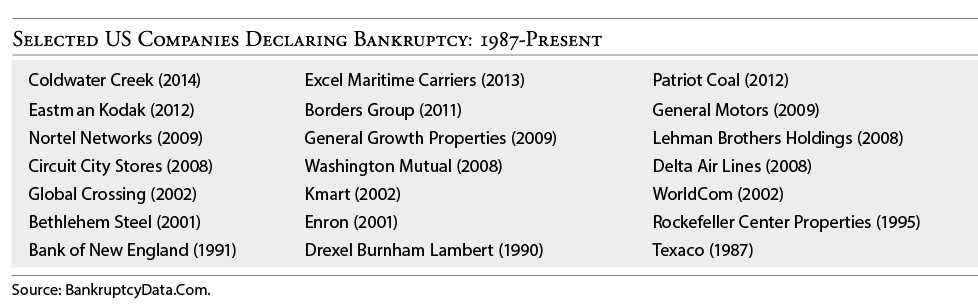

Setting those facts aside, some investors might be comforted by a “name brand” stock in their portfolio Remember that bankruptcies can occur even to some of the most recognizable household names such as Eastman Kodak, Circuit City, Delta, General Motors, and others (Figure 3). With the benefit of hindsight, some may say that these bankruptcies were predictable, but each company’s management, their board of directors, the credit rating agencies, and concentrated stock holders may have incorrectly believed in each company’s long-term success.

Figure 3: Selected US Companies Declaring Bankruptcy

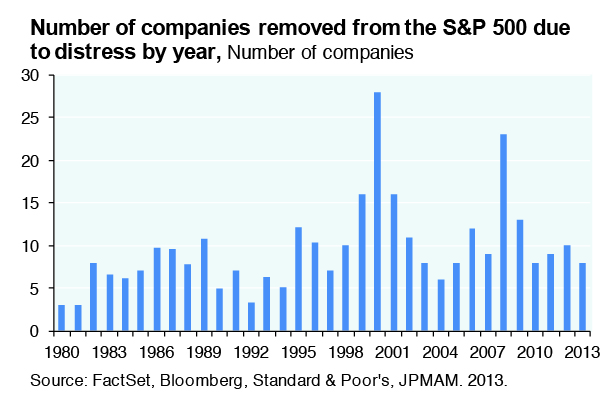

The S&P 500 is widely viewed as a basket of the largest, safest, most successful companies to own in the world. But even in this relatively stable universe, companies are removed from the index each and every year due to distress (Figure 4). Since 1980, more than 320 stocks have been removed from the S&P 500 Index due to failure outright, substantial declines in price, or acquisition after substantial declines in price.[1]

The S&P 500 is widely viewed as a basket of the largest, safest, most successful companies to own in the world. But even in this relatively stable universe, companies are removed from the index each and every year due to distress (Figure 4). Since 1980, more than 320 stocks have been removed from the S&P 500 Index due to failure outright, substantial declines in price, or acquisition after substantial declines in price.[1]

Figure 4:

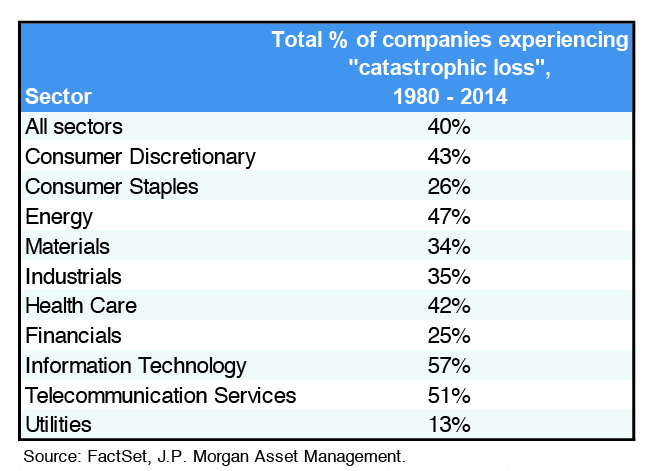

Diversified investors who held on during the Great Financial Crisis were rewarded with larger gains in the years to come. But this isn’t always the case for individual stocks. Even if your concentrated stock holding survives a recession and doesn’t end up going bankrupt, it may be [i]unrealistic to believe that it will fully recover in value after a steep drawdown. Since 1980, roughly 40% of all stocks in the Russell 3000 suffered a 70% decline from their peak value with minimal recovery (Figure 5). For certain, more economically sensitive sectors like Tech and Metals & Mining, those numbers were even greater.[2]

Diversified investors who held on during the Great Financial Crisis were rewarded with larger gains in the years to come. But this isn’t always the case for individual stocks. Even if your concentrated stock holding survives a recession and doesn’t end up going bankrupt, it may be [i]unrealistic to believe that it will fully recover in value after a steep drawdown. Since 1980, roughly 40% of all stocks in the Russell 3000 suffered a 70% decline from their peak value with minimal recovery (Figure 5). For certain, more economically sensitive sectors like Tech and Metals & Mining, those numbers were even greater.[2]

Figure 5:

Investors holding concentrated stock positions face the very real risk that a change in the fortunes of a single company could jeopardize their financial well-being. No company, no matter how seemingly strong or well-positioned, is immune from risk.

Investors holding concentrated stock positions face the very real risk that a change in the fortunes of a single company could jeopardize their financial well-being. No company, no matter how seemingly strong or well-positioned, is immune from risk.

Don’t tie an active portfolio manager’s hands

For many investors, the ability of their portfolio manager to beat the market, (or a predefined benchmark) is a key driver of satisfaction. But in order to put your portfolio in the best position to succeed, he or she needs as much latitude as possible to add value within their area of expertise. To the extent you constrain any active manager with extensive tax limitations, they may be less likely to add value. Often, considerably more value can be added by repositioning a portfolio to take advantage of the market environment, rather than doing nothing to save a few dollars in taxes.

The taxman cometh

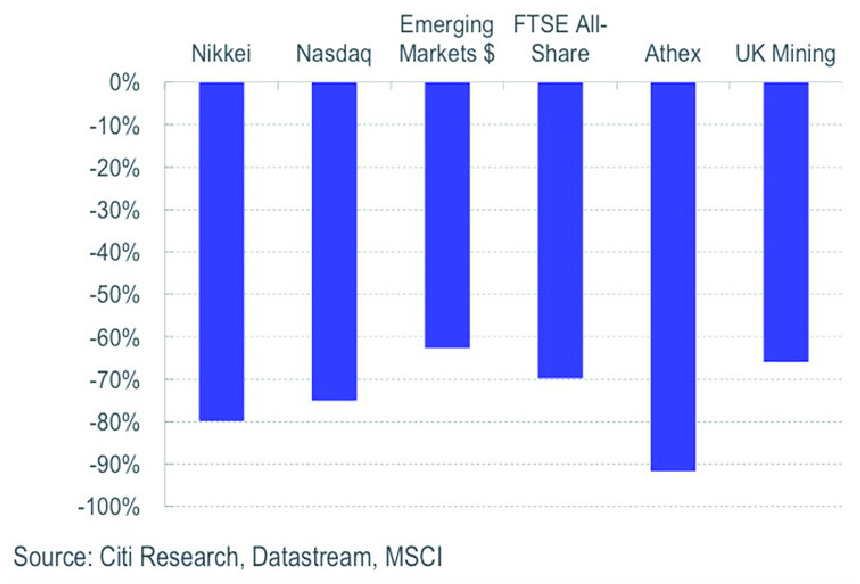

There is certainly economic value in deferring the payment of taxes for as long as possible. Why give the government money today when you could use that money more productively yourself? This logic makes a great deal of sense. Tax deferral is valuable but, unless you’re planning on holding onto your portfolio until death and receiving a basis step-up at that time, the tax bill always comes due. Typically, it just grows over time as markets rise. Don’t be afraid to rebalance your portfolio, even if it involves realizing some capital gains. While even diversified indexes like the S&P 500 can have massive down years (-39% in 2008[3]), individual sectors can perform far worse (Figure 6). The benefits of a diversified portfolio, with lower single stock or concentrated sector risks, are usually far greater than the tax costs. And conversely, the risks of holding concentrated positions, susceptible to steeper than average drawdowns and potentially increased stress on the stockholder, are often far costlier than a tax bill.

Figure 6: Max Drawdown (Price, Local)

Smart, long-term financial decisions need to take more than just taxes into consideration. Assess your financial and investment goals as well as the risks of holding concentrated stock positions or an undiversified portfolio as part of the decision-making process. While tax bills are never fun, they are a reality of living in this great country of ours. There are a host of strategies you can deploy to help mitigate your tax liability, but always beware of “letting the tax tail wag the investment dog.”

Smart, long-term financial decisions need to take more than just taxes into consideration. Assess your financial and investment goals as well as the risks of holding concentrated stock positions or an undiversified portfolio as part of the decision-making process. While tax bills are never fun, they are a reality of living in this great country of ours. There are a host of strategies you can deploy to help mitigate your tax liability, but always beware of “letting the tax tail wag the investment dog.”

Securities offered through Royal Alliance Associates, Inc. member FINRA/SIPC. Investment advisory services offered through SEIA, LLC, 2121 Avenue of the Stars, Suite 1600, Los Angeles, CA 90067, (310) 712-2323. Royal Alliance Associates, Inc. is separately owned and other entities and/or marketing names, products or services referenced here are independent of Royal Alliance Associates, Inc. Royal Alliance Associates, Inc. does not offer tax or legal advice.

[1] JPMorgan:

[2] JPMorgan: https://nas/content/staging/seia.chase.com/content/dam/privatebanking/en/mobile/documents/eotm/eotm_2014_09_02_agonyescstasy.pdf

[3] Bloomberg

[i] * There is no guarantee that a diversified portfolio will outperform a non-diversified portfolio in any given market environment.

Third Party Site

The information being provided is strictly as a courtesy. When you link to any of the websites provided here, you are leaving this website. We make no representation as to the completeness or accuracy of information provided at these websites. Nor is the company liable for any direct or indirect technical or system issues or any consequences arising out of your access to or your use of third-party technologies, websites, information and programs made available through this website. When you access one of these websites, you are leaving our web site and assume total responsibility and risk for your use of the websites you are linking to.

Dated Material

Dated material presented here is available for historical and archival purposes only and does not represent the current market environment. Dated material should not be used to make investment decisions or be construed directly or indirectly, as an offer to buy or sell any securities mentioned. Past performance cannot guarantee future results.