Are We There Yet? Part II

By Deron T. McCoy, CFA®, CFP®, CAIA®

Chief Investment Officer

It’s official. We are now technically in a bear market. Thus far in 2022, the S&P 500® is down 22%. There’s even more pain elsewhere—with Small Caps off 25% YTD, and the Nasdaq falling more than 30%!

But if you think that’s bad, keep in mind that Bitcoin, as of 6/16/22, lost a whopping 26% over the past week!

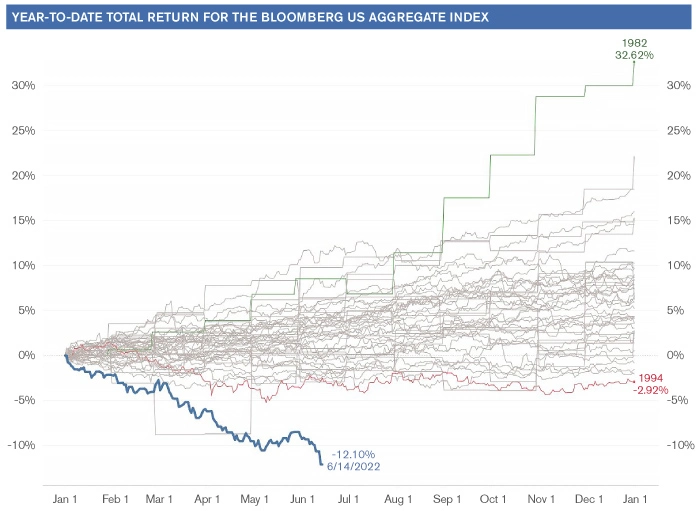

Even the bond market is suffering some sizeable losses, with the Bloomberg U.S. Aggregate Index off to its worst start to a year—ever.

Bond losses and higher interest rates are also permeating into other assets as well: especially mortgages.

Since 1988, the Barclays/Bloomberg Mortgage Aggregate (a broad index of mortgage-backed securities guaranteed by Government Sponsored Entities and Agencies that carry no credit risk) had never fallen more than 1.72% in a two-day span. According to Bespoke Investment Group, since last Thursday’s close (6/9/22), that broad index has fallen 2.8%—”an absolutely jaw-dropping move that can only be described as the extinction of bids across the mortgage universe.”

Source: Bloomberg

What are the ramifications? According to Mortgage News Daily, for the first time since 2008 mortgage rates as of June 16th, topped 6%—potentially wrecking the housing market and related industries. Consider that in April, the median home price and national average mortgage rate combined had pushed up a monthly payment proxy by 45% versus the year before. Assuming rates stay steady through July, payments will be up a record 63.2% year-over-year. At a minimum, this will likely curtail home price appreciation and potentially could be much worse: “destroying demand on a truly epic scale,” according to Bespoke. And this doesn’t even factor in the meteoric rise in food and energy prices—which are destined to further crimp the U.S. consumer.

IT DOESN’T FEEL LIKE WE ARE THERE YET, BUT…

While we’re living and investing in interesting times, with a potential economic slowdown ahead, it’s wise to remember that stocks price in future events. They’ve already sold off on fears of higher inflation, fears of a hiking cycle (amid slowdown), and fears of a 4% fed funds rate in early 2023. What investors need to determine now is whether any investment adequately compensates you for the inherent risks that lie ahead. After a 20-30% decline with signs of capitulation in other markets, the answer appears to be getting closer to ‘yes.’

We are all human—and unfortunately, we’re not wired in a way that makes investing easy. We’re wired to run away from a bear when in fact we should be running towards it—as that’s when major wealth is created. We understand that it’s hard to rationalize the above in the face of a potential recession (rather than simply running for the hills). So instead, let’s try to visualize it. Let’s frame current events with those from the last non-pandemic recession—namely the 2009-2010 time frame.

Everyone remembers the Great Financial Crisis, stock selloff and recession of fourteen years ago. But what you might have forgotten is that stocks bottomed in late 2008 and again in early 2009 with the pain centered squarely on Wall Street. However, the real economic pain didn’t come until later. Fast forward into 2010 and stocks were higher while the pain on Main Street continued with some home prices not bottoming until 2011. If an investor had waited until it ‘felt like the economy was better,’ they would have missed out on 50-100% of the stock price recovery.

In short, while a recession may lie ahead, stocks very well may have already priced it in.

Stick to your financial plan. Stocks sell off—it’s what they do. Just make sure to plan ahead so that you aren’t a forced seller at the bottom. Instead, embrace the upcoming weakness and you’ll likely benefit from it another 5 years down the road. Simply put, volatility is the price you must pay now to reap outsized returns in the next market cycle.

The information contained herein is for informational purposes only and should not be considered investment advice or a recommendation to buy, hold, or sell any types of securities. Financial markets are volatile and all types of investment vehicles, including “low-risk” strategies, involve investment risk, including the potential loss of principal. Past performance does not guarantee future results. For details on the professional designations displayed herein, including descriptions, minimum requirements, and ongoing education requirements, please visit seia.com/disclosures. Signature Estate & Investment Advisors, LLC (SEIA) is an SEC-registered investment adviser; however, such registration does not imply a certain level of skill or training and no inference to the contrary should be made. Securities offered through Royal Alliance Associates, Inc. member FINRA/SIPC. Investment advisory services offered through SEIA, 2121 Avenue of the Stars, Suite 1600, Los Angeles, CA 90067, (310) 712-2323. Royal Alliance Associates, Inc. is separately owned and other entities and/or marketing names, products, or services referenced here are independent of Royal Alliance Associates, Inc.

Third Party Site

The information being provided is strictly as a courtesy. When you link to any of the websites provided here, you are leaving this website. We make no representation as to the completeness or accuracy of information provided at these websites. Nor is the company liable for any direct or indirect technical or system issues or any consequences arising out of your access to or your use of third-party technologies, websites, information and programs made available through this website. When you access one of these websites, you are leaving our web site and assume total responsibility and risk for your use of the websites you are linking to.

Dated Material

Dated material presented here is available for historical and archival purposes only and does not represent the current market environment. Dated material should not be used to make investment decisions or be construed directly or indirectly, as an offer to buy or sell any securities mentioned. Past performance cannot guarantee future results.