The SEIA Report Q2 2023

By Gene Balas, CFA®

Investment Strategist

How Artificial Intelligence Can Benefit Investors – But Introduce New Risks

What comes to mind when we think about artificial intelligence (AI)? Recent news articles seem to have been dominated by generative AI in popular software applications, such as ChatGPT and tools that can generate not just text, but also images as well. While the aspect of AI that can, theoretically, write and create news articles, emails, and pictures on its own has captivated many people, it is not by any means the only story. There are quite a few items to unpack when discussing AI.

Government Regulations to Combat Nefarious AI Uses

AI is not limited to things such as streaming services that suggest movies or music, or autocomplete functions in email or word processing, AI also extends to other areas, including warfare and weaponry. AI that can generate computer code can be used by hackers, and AI that can help develop new medicines can also be used by terrorists to create new chemical or biological agents. Given those more sinister applications, government regulations will almost certainly be instituted.

Already, Biden administration officials have been preparing a new executive order that may restrict U.S. investment into technologies developed by some of the U.S.’s geopolitical rivals, such as China. And export restrictions of certain hardware, such as certain advanced semiconductors used in AI systems, have already been introduced. A primary goal of the Biden administration is to prevent U.S. investments in AI-related technologies from aiding our rivals’ military capabilities or terrorist organizations.

And lawmakers on Capitol Hill are seeking to catch up to Europe’s head start on its own regulatory packages addressing some of the perils of AI. Senate Majority Leader Charles E. Schumer (D-N.Y.) recently launched a broad congressional effort to set new rules for AI to address concerns about the technology’s impact on privacy, intellectual property, and national security, among other concerns. Certainly, investors will need to be cognizant of any government policies implemented in order to control technologies that are essentially black boxes (and which may produce unintended results). Some regulations can throttle certain potential investment opportunities; others might not.

Investment Opportunities from AI

Speaking of investment opportunities from AI, many investors have focused simply on the most obvious and direct beneficiaries of the introduction of AI systems, including companies involved in both hardware, such as makers of semiconductors and equipment, and software that can harness AI functions. However, some of these companies have drawn significant investor interest that may already be reflected in their current share prices.

Similar to the dot com mania in the late 1990s and into early 2000 – before the bursting of the dot com bubble and the broader bear market that followed – one may wonder, in the current environment, if the prices of certain of these AI-themed stocks have risen too far, too fast. Maintaining a sensible exposure to the broader economy and the opportunities presented by all sectors – including technology companies – is one thing, but one may need to be a bit circumspect before pouring one’s entire portfolio into a basket of just a few AI-themed stocks.

Really, though, the beneficiaries of AI aren’t limited to just a handful of stocks that are most directly associated with producing AI hardware and software. Rather, the benefits of AI might eventually flow through the entire economy, and benefit economic growth broadly, potentially supporting share prices across a broad array of sectors.

The mechanism by which AI can bolster both the economy and the market is through increased productivity, which can increase the potential amount of output in the economy. And companies that deploy AI thoughtfully might generate higher profits. This can benefit not just the handful of stocks investors to which investors associate AI most closely, but also many companies in the broader market.

Goldman Sachs economists estimate that widespread AI adoption could boost productivity growth by roughly 1.5 percentage points per year over a 10-year period. In this scenario with widespread adoption of AI that occurs in 10 years, real GDP growth could be increased by 1.1 percentage points for that 10-year period, according to the economists’ estimates. In turn, earnings per share (EPS) of the companies in the S&P 500 in 20 years would be 11% greater than Goldman’s current baseline assumption, and the S&P 500 fair value would be 9% higher than today, holding all else equal, in Goldman’s calculations.

Potential Economic Risks and Corporate Tax Policy Responses

However, the timing and ability of S&P 500 companies to generate incremental profits from AI is uncertain. And policymakers may address any labor displacement from AI adoption with additional regulations – or increased corporate income tax rates – to help displaced workers.

Indeed, Goldman Sachs economists’ estimate that two-thirds of US occupations are exposed to some degree of automation by AI. Of those occupations that are exposed, most have a significant—but partial—share of their workload, ranging from 25% to 50%, that can be replaced. Of course, some workers may apply freed-up time to other activities, and new jobs may provide further opportunities.

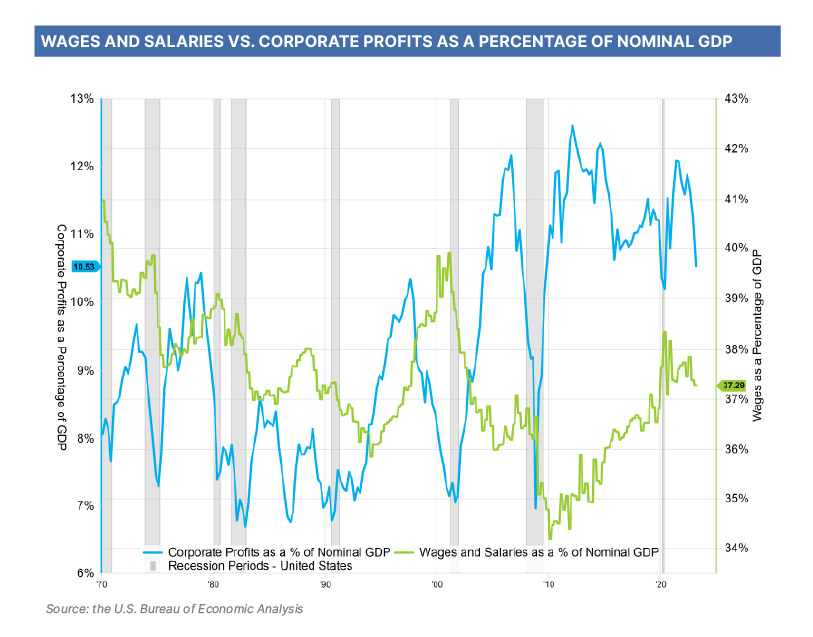

Importantly, though, the risk of labor force displacement – and the possible effort by government policymakers to address the issue through the tax code – is especially true given the historically low level of wages as a share of GDP, as seen in the nearby graph. Views that the benefits of AI are disproportionately flowing to corporations and large shareholders can prompt changes to tax policies.

Conclusion

Whatever the implications of AI may turn out to be, the process will likely not be immediate, nor will it necessarily extend to every sector, industry, or company equally. Some companies may adopt AI technology more successfully or earlier than other companies might. On the other hand, some companies may find that large investments into AI technologies may turn out to have been costly mistakes.

Still, close attention to the promises – and the perils – associated with AI is important, especially as the technology progresses, novel uses for it are identified, new government regulations are finalized, and any tax ramifications are codified.

At SEIA, we monitor the ever-evolving landscape of the economy and markets, ranging from broad government policies to company-specific fundamentals. As always, please reach out to your SEIA or SIA advisor. He or she will gladly assist you in making the right decisions to help you achieve your financial goals – and avoiding media hype in the process.

Signature Estate & Investment Advisors, LLC (SEIA) is an SEC-registered investment adviser; however, such registration does not imply a certain level of skill or training and no inference to the contrary should be made. The information contained herein is the opinion of SEIA and is subject to change at any time. It is not intended as tax, legal or financial advice, and it may not be relied on for the purpose of avoiding any federal tax penalties. You are encouraged to seek such advice from your professional tax, legal or financial advisor. The content is derived from sources believed to be accurate but not guaranteed to be. For a complete listing of sources please contact SEIA. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Past performance is not indicative of future results. Every investment program has the potential for loss as well as gain. There is a risk of loss from an investment in securities, including the risk of loss of principal. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be profitable or suitable for a particular investor’s financial situation or risk tolerance. Asset allocation and portfolio diversification cannot assure or guarantee better performance and cannot eliminate the risk of investment losses. For details on the professional designations displayed herein, including descriptions, minimum requirements and ongoing education requirements, please visit www.seia.com/disclosures. Securities offered through Royal Alliance Associates, Inc. member FINRA/SIPC. Investment advisory services offered through SEIA, 2121 Avenue of the Stars, Suite 1600, Los Angeles, CA 90067, 310-712-2323. Royal Alliance Associates, Inc. is separately owned and other entities and/or marketing names, products or services referenced here are independent of Royal Alliance Associates, Inc.

Third Party Site

The information being provided is strictly as a courtesy. When you link to any of the websites provided here, you are leaving this website. We make no representation as to the completeness or accuracy of information provided at these websites. Nor is the company liable for any direct or indirect technical or system issues or any consequences arising out of your access to or your use of third-party technologies, websites, information and programs made available through this website. When you access one of these websites, you are leaving our web site and assume total responsibility and risk for your use of the websites you are linking to.

Dated Material

Dated material presented here is available for historical and archival purposes only and does not represent the current market environment. Dated material should not be used to make investment decisions or be construed directly or indirectly, as an offer to buy or sell any securities mentioned. Past performance cannot guarantee future results.