Staying the Course

By Wendy Norman

Fixed Income Specialist

We’re all familiar with the expression ‘Stay in your lane.’ What you may not realize, however, is how apt that metaphor is for the current investment landscape – as you find yourself inundated on all sides by market noise about inflation, interest rates, a pending recession and the implications they’ll all have on your investment portfolio.

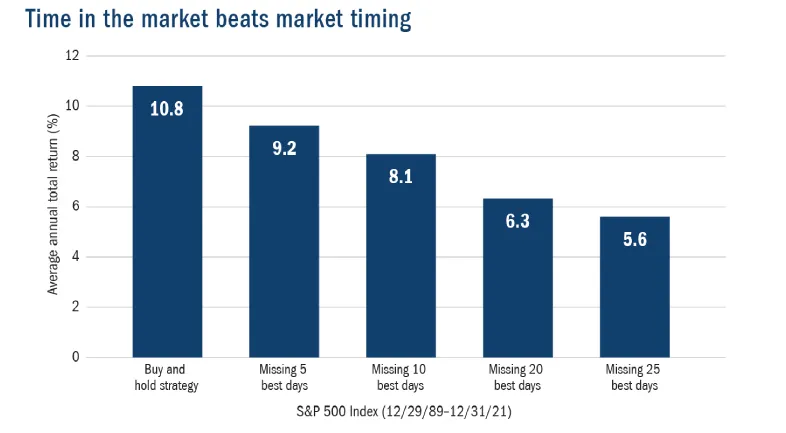

In actuality, the thing that drives many investors is fear. When the market’s soaring, you’re glad you didn’t miss out because you’ve been fully invested. But when the market starts heading south, you’re quickly tempted to cash out and avoid possible future losses. Yet it’s virtually impossible to have it both ways. When it comes to successfully timing the market, the odds are stacked against you. Not only do you need to guess exactly the right time to exit the market, but you also need to precisely pinpoint when it’s time to get back in.

A recent study by Bank of America examined the performance of the S&P 500® since 1929. The analysis found that while losses occurred in about one out of every four one-year periods (26%), that figure drops to 6% when measured in 10-year increments. And over 20-year periods, the S&P 500 has never experienced a net price decline.[1]

That’s why it’s important to keep your focus on longer time horizons. While all the newspapers, websites and media outlets ping-pong back and forth between predictions that either ‘the sky is falling’ or ‘the bottom is in and the bull is running,’ remember that it’s nothing more than a distraction. Today there are algorithms, day traders, and hedge funds that invest solely based off each day’s economic market releases – determining whether the most recent data signifies a bear or bull market.

In fact, many of the recent large market swings aren’t predicated on fundamentals but rather on hypotheticals. Reacting to these gyrations, however, can have a profoundly negative impact on individual investors – whose investment mandates are built around time horizons that are measured in years, not months. Never lose sight of this one important fact: between 1945 and 2020, the average duration of recessions was a mere 10 months[2] Avoid paying attention to daily market movements and you’ll be better able to avoid making short-term decisions with long-term implications.

At the 30,000-foot level

Don’t fall into the trap of thinking that financial plans are set in stone. Even though you and your financial advisor craft an asset allocation that suits your particular goals, income needs, risk appetite and time horizon at a given point in time, that plan should evolve as your life evolves. Changes in marital relationships, births and deaths, unexpected health issues, dissolution of a business – these are the things (not news events) that should drive changes to your portfolio. It’s the difference between being proactive and being reactive.

[1] New York Times 05.20.22 “Stocks Have Been Falling” by Jeff Sommer

[2] National Bureau of Economic Research, Forbes 07.29.22

Source: Columbia Management Investment Advisers, LLC and Bloomberg as of 12/31/21. Past Preformance does not guarantee future results. The S&p 500 Index tracks the preformance of 500 widely held, large-capitalization U.S. stocks. It is not possible to invest directly in an index.

At ground level

Any time you experience a life event that may warrant a shift in your overall asset allocation, make sure you and your advisor consider the following:

- Does the new diversification profile align with your long-term objectives?

- Is the right attribution being given to various sectors within asset classes?

- Do you have the right ‘risk-on/risk-off’ concentrations (has your risk profile shifted due to life events that warrant an underweight, overweight or neutral shift)?

- Are there tax considerations at present or on the horizon (based on a change in employment, business structure, domicile, or cash need) to consider?

At eye level

Keep your focus clear. Stay in your lane with your eyes on the road ahead – knowing there will be a bump or two in the road. But whatever you do, don’t exit thinking there’s a shortcut. More often than not, what you thought was a shortcut ends up leading you further away from your destination. So, stay the course.

The information contained herein is for informational purposes only and should not be considered investment advice or a recommendation to buy, hold, or sell any types of securities. Financial markets are volatile and all types of investment vehicles, including “low-risk” strategies, involve investment risk, including the potential loss of principal. Past performance does not guarantee future results. For details on the professional designations displayed herein, including descriptions, minimum requirements, and ongoing education requirements, please visit seia.com/disclosures. Signature Estate & Investment Advisors, LLC (SEIA) is an SEC-registered investment adviser; however, such registration does not imply a certain level of skill or training and no inference to the contrary should be made. Securities offered through Royal Alliance Associates, Inc. member FINRA/SIPC. Investment advisory services offered through SEIA, 2121 Avenue of the Stars, Suite 1600, Los Angeles, CA 90067, (310) 712-2323. Royal Alliance Associates, Inc. is separately owned and other entities and/or marketing names, products, or services referenced here are independent of Royal Alliance Associates, Inc.

Third Party Site

The information being provided is strictly as a courtesy. When you link to any of the websites provided here, you are leaving this website. We make no representation as to the completeness or accuracy of information provided at these websites. Nor is the company liable for any direct or indirect technical or system issues or any consequences arising out of your access to or your use of third-party technologies, websites, information and programs made available through this website. When you access one of these websites, you are leaving our web site and assume total responsibility and risk for your use of the websites you are linking to.

Dated Material

Dated material presented here is available for historical and archival purposes only and does not represent the current market environment. Dated material should not be used to make investment decisions or be construed directly or indirectly, as an offer to buy or sell any securities mentioned. Past performance cannot guarantee future results.