Are We Entering a 21st Century Version of the Great Depression?

By Sam Miller, CFA®, CFP®, CAIA®

Senior Investment Strategist

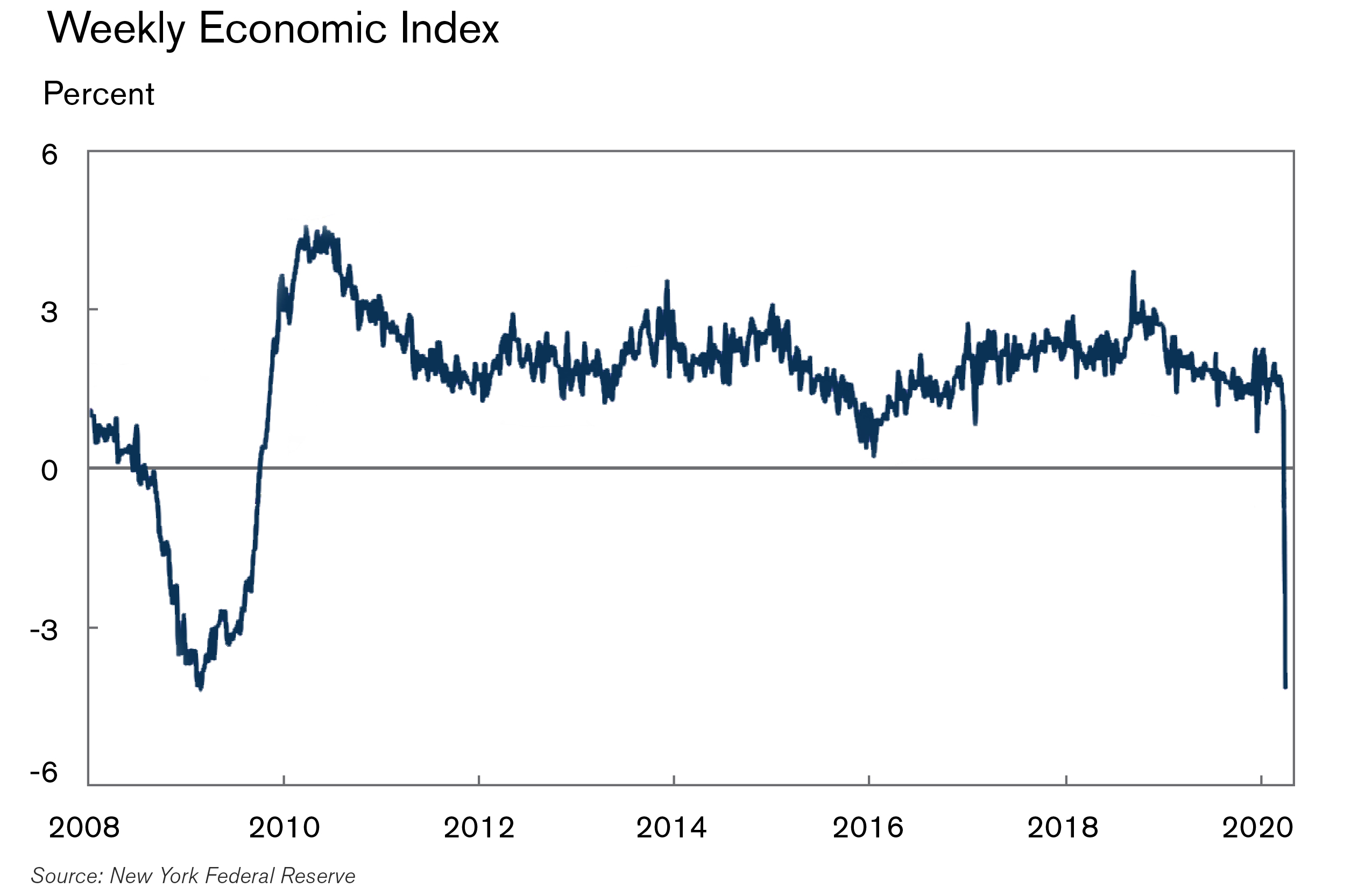

Last week’s unemployment data (3.28 million jobless claims) was just the tip of the iceberg. The economic data that will be announced over the coming weeks and months stands to be equally unprecedented and, to put it mildly, sobering. The NY Fed’s newly formed Weekly Economic Index offers a glimpse into the steepness of the decline in economic activity (see chart below). When it’s released, the second quarter’s GDP print will likely amount to the worst quarterly U.S. GDP downturn in the nation’s history. The velocity at which markets corrected, accompanied by historic volatility, has many investors fearing that this may likely be the beginning of a 21st century Great Depression. There are, however, many differences between today and 1929 that lead us to believe this is not the case. To explain why, let’s first look at the Great Depression era.

In 1929 and into the 1930s, government policies became more restrictive on a number of fronts:

- The Fed tightened monetary policy. In his book The Great Crash, 1929, famed economist John Kenneth Galbraith notes that “the Federal Reserve Board in those times was a body of startling incompetence.” Having been formed only 16 years prior, the Fed lacked the experience to navigate stresses to the financial system, leading to a run on the banks and several bank failures.

- Income taxes were increased on both corporations and individuals. Both Republicans and Democrats sought to balance the budget and cut spending. Even in 1932, at the depths of the depression, they wanted to shrink spending by 25%.

- Regulations were expanded. Following a bank holiday in 1933 that closed all the nation’s banks, a raft of new regulations designed to curb bank failures were announced. While bank runs ceased and failures dropped, bank lending remained muted at a time when it was most needed to fuel the financial system.

- Trade barriers were increasing. The Smoot-Hawley Tariff Act of 1930 raised import duties in an attempt to protect American businesses. Instead of helping, however, it added considerable strain to the economic climate.

All of these actions contributed to both the length and severity of the Great Depression. Whereas over the past month, policymakers have done the exact opposite – becoming not only less restrictive, but historically accommodative.

While the last six weeks of market action has indeed been historic, the accompanying policy response has been unprecedented in scale, scope, and speed. The Federal Reserve is clearly in “do whatever it takes” mode: slashing the Fed Funds rate to zero, cutting reserve requirements, and moving to unlimited QE that might see their balance sheet grow by $500 billion/month. And most recently, the Fed has opened programs to add liquidity to the money market, muni, commercial paper, and investment-grade markets.

On the fiscal side of the equation, the CARES Act which was passed late last week, directs $2.2 trillion toward individuals and businesses. This amounts to more than 10% of annual GDP – more than twice the relief that was provided during the Great Financial Crisis.

While the biggest factor in determining the length and severity of this recession hinges on the extent to which the spread of this virus can be slowed, we believe that the actions taken by policymakers in recent days, along with the commitment to do more in the future, will be enough to bridge the crisis.

Although the information has been gathered from sources believed to be reliable, it cannot be guaranteed. The information contained herein reflects the firm’s views and is subject to change at any time without notice. Views expressed in this article may not reflect the views of Royal Alliance Associates, Inc. Securities offered through Royal Alliance Associates, Inc. member FINRA/SIPC. Investment advisory services offered through SEIA, LLC, 2121 Avenue of the Stars, Suite 1600, Los Angeles, CA 90067, (310) 712-2323. Royal Alliance Associates, Inc. is separately owned and other entities and/or marketing names, products or services referenced here are independent of Royal Alliance Associates, Inc.

Third Party Site

The information being provided is strictly as a courtesy. When you link to any of the websites provided here, you are leaving this website. We make no representation as to the completeness or accuracy of information provided at these websites. Nor is the company liable for any direct or indirect technical or system issues or any consequences arising out of your access to or your use of third-party technologies, websites, information and programs made available through this website. When you access one of these websites, you are leaving our web site and assume total responsibility and risk for your use of the websites you are linking to.

Dated Material

Dated material presented here is available for historical and archival purposes only and does not represent the current market environment. Dated material should not be used to make investment decisions or be construed directly or indirectly, as an offer to buy or sell any securities mentioned. Past performance cannot guarantee future results.